CHOM care

CHOM CAPITAL ACTIVE RETURN EUROPE UI

Investment approach

The essence of the CHOM CARE investment concept is putting together a portfolio driven by fundamentals. To limit our investment universe, we screen potential investments using strict ESG exclusion criteria based on international norms. The European investment universe comprises some 6,000 listed companies. The CARE investment concept focuses on listed European companies of all sizes (all caps) that meet the portfolio’s liquidity requirements.

The CHOM Active Return Europe UI portfolio is made up of focused all-cap investments whose attractive fundamentals make them likely to deliver significant added value. Our portfolio companies are pinpointed solely on the basis of their business outlook, i.e. stock selection is not tied to specific benchmarks, sectors or regions.

“Our stock selection is not tied to specific countries or indices. The quality of a company is what counts for us.”

- Oliver Schnatz, Founder and Portfolio Manager

Investment strategy

![]()

Our key stock selection instrument are the close contacts we have built up over the past 20 years with company managements. Every year, we hold more than 600 meetings with executive bodies of our portfolio companies to discuss the previously analysed financial and non-financial ESG aspects and to penetrate business models, corporate strategy and key value drivers. We also gain insight into factors such as product quality, customer and supply chains, market structures and market entry barriers which in turn enhances our understanding of the companies.

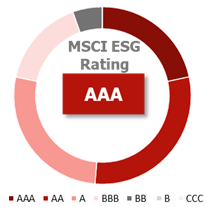

In addition to these on-site meetings, valuable research information is also obtained from other sources. The fundamental data needed for our screening, portfolio and reporting models, for instance, is procured from various external research providers (brokers) and high-quality data feeds (Bloomberg and FactSet). External ESG data is obtained from MSCI is one of our main sources of external ESG data.

In order to single out first-rate companies that qualify for the portfolio, our managers seek out fundamental, long-term value drivers such as excellent sustainability ratios, steady business sector growth, changing trends in business models, mispricing, or restructuring efforts. The next step is to analyse and filter these ideas more closely with the help of valuation techniques that use an income-based approach (DCF models, multiple valuation, peer group analyses) or intrinsic value methods (analysis of balance sheet quality). An analysis of how well companies have integrated the individual ESG criteria into their business models is also a decisive factor for the fund’s investment strategy.

Some 40 stocks are eventually selected for CHOM’s top quality portfolio on the basis of the business model evaluation and further talks with senior company representatives. Each equity selected for the portfolio is initially given an equal weighting to ensure that it has a significant influence on results.

"We believe in doing things with a steady hand. Each investment is hand picked with care and has a significant impact on our portfolio."

- Christoph Benner, Founder, CEO & Portfolio Manager

More Information about CARE

![]()

CHOM CAPITAL ACTIVE RETURN EUROPE UI

Institutional Share Class

WKN: A1J CWS

ISIN: DE000A1JCWS9

Bloomberg: CHOMCAR

CHOM CAPITAL ACTIVE RETURN EUROPE UI

Retail Share Class

WKN: A1J UU4

ISIN: DE000A1JUU46

Bloomberg: CHOMAKR

Do you need more detailed information for your investment decision?

We are happy to answer your questions and requests

Christoph Benner, Founder, CEO & Portfolio Manager

sustainamentals@chomcapital.com

+49 69 260 1599-60